Difference between revisions of "Automated invoice checks and validation"

Stefanseiler (talk | contribs) |

Stefanseiler (talk | contribs) |

||

| (5 intermediate revisions by the same user not shown) | |||

| Line 26: | Line 26: | ||

This deeper knowledge means that accounts payable automation is no longer required, as all information is matched and available by design on both b-op digitals of the business. This eliminates the entire work for which ap automation was required. All what needs to be ensured in the procure-to-pay process on the purchasing side is: | This deeper knowledge means that accounts payable automation is no longer required, as all information is matched and available by design on both b-op digitals of the business. This eliminates the entire work for which ap automation was required. All what needs to be ensured in the procure-to-pay process on the purchasing side is: | ||

* '''correct approval of the purchase order''' - this is a must have process, so that only purchase orders leave the company when financial, material and/or personal equipment approval have been granted | * '''correct approval of the purchase order''' - this is a must have process, so that only purchase orders leave the company when financial, material and/or personal equipment approval have been granted. Please [[Approval mechanisms|read up here]] on the various order [[approval mechanisms]] supported by ZUGSEIL. | ||

* '''goods delivery confirmation''' - before any payment can be made the goods or services must have been delivered and the receipt has to be confirmed by an internal party. Please read up on the [[delivery confirmation strategies]] supported with ZUGSEIL. | * '''goods delivery confirmation''' - before any payment can be made the goods or services must have been delivered and the receipt has to be confirmed by an internal party. Please [[Delivery confirmation strategies|read up here]] on the [[delivery confirmation strategies]] supported with ZUGSEIL. | ||

A b-op based system can then automatically check if the arrived bill is legit and matches the approved purchase order and the delivered goods or service. If so, the payment can be automatically triggered and pushed forward to liquidity planning, whith out any further manual checks. | A b-op based system can then automatically check if the arrived bill is legit and matches the approved purchase order and the delivered goods or service. If so, the payment can be automatically triggered and pushed forward to liquidity planning, whith out any further manual checks. | ||

| Line 69: | Line 69: | ||

== Related articles == | == Related articles == | ||

* [[ZUGSEIL Procurement Tools]] | |||

*[[ZUGSEIL Procurement | |||

*[[ZUGSEIL Quality and Returns Management (QRM)]] | *[[ZUGSEIL Quality and Returns Management (QRM)]] | ||

*[[ZUGSEIL | *[[ZUGSEIL PATTY]] | ||

* [[ | * [[Warehouse Management System (WMS)]] | ||

[[Category:Business Epics|Category:Business Epics]] | |||

Latest revision as of 11:17, 30 October 2025

Before any supplier bill should to be payed, it must be validated against arrived deliveries.

Manual validation

In former times this process happened manually:

- The bookkeeping department had a workflow established, that all delivery paper was signed by the person which received goods and send this paper to the bookkeeping

- Whenever a bill arrived, the matching delivery papers had to be searched for and matched against the bill

- If there were any non-matching items, the manual process of calling and researching startet, which was a very cumbersome process.

Since the introduction of controlling tools this research process even increased complexity, as costcenters (to which bills were to be bound) might not match or even not exist ... . All this increased complexity and workload in the bookkeeping department without real value being created.

Accounts payable (AP) automation

AP automation tools like basware support and partially digitalize this manual process and are currently wide spread. Here are some of the main features that attracted businesses to AP automation:

- Simplified data entry: Automatically upload supplier and billing data in a consistent digital format

- Automated invoice matching: Match purchase orders, goods received notes, and supplier invoices more quickly

- Consistent invoice coding: Set rules that automatically attribute the correct ledger codes for every supplier invoice.

- Efficient approvals: Automatically route invoice and billing approvals to the right stakeholders, who can review and sign electronically. With this comes faster approvals and greater transparency in the accounts payment workflow.

- Simplified data governance: Audit all your accounts payable data using a single software interface rather than paper records. This reduces audit time, and rapid audits are integral to data governance and compliance operations.

Accounts payable (AP) integration with b-op

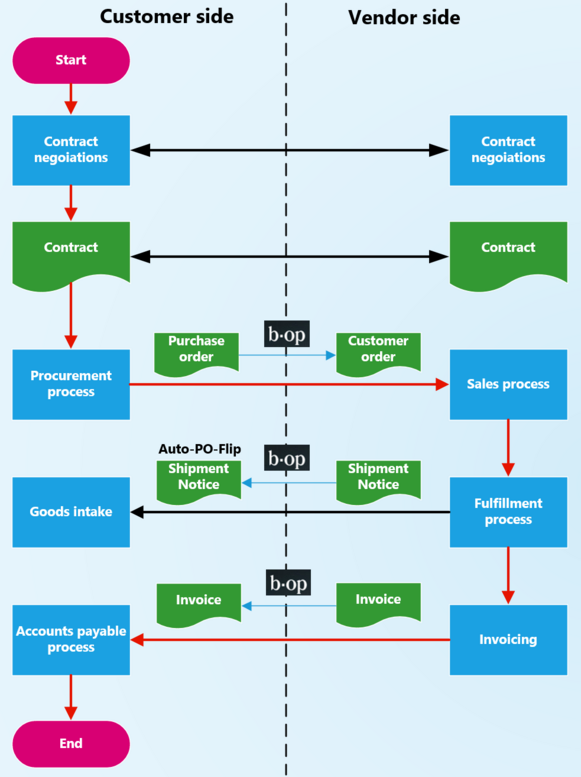

B-Op governs a full data exchange along the entire procurement to pay (P2P) process once the contract is made. This means that from the internal order taken, the purchase order being approved, the fulfillment being made, the shipments having arrived and the bill written ... each step is digitally integrated and shared by both business partners.

This deeper knowledge means that accounts payable automation is no longer required, as all information is matched and available by design on both b-op digitals of the business. This eliminates the entire work for which ap automation was required. All what needs to be ensured in the procure-to-pay process on the purchasing side is:

- correct approval of the purchase order - this is a must have process, so that only purchase orders leave the company when financial, material and/or personal equipment approval have been granted. Please read up here on the various order approval mechanisms supported by ZUGSEIL.

- goods delivery confirmation - before any payment can be made the goods or services must have been delivered and the receipt has to be confirmed by an internal party. Please read up here on the delivery confirmation strategies supported with ZUGSEIL.

A b-op based system can then automatically check if the arrived bill is legit and matches the approved purchase order and the delivered goods or service. If so, the payment can be automatically triggered and pushed forward to liquidity planning, whith out any further manual checks.

As a result, processes like invoice checks and validation are no longer required. As the system can detects inconsistencies in that process chain created on one side by manual change, fraud or error is impossible.

This fact saves businesses significant time and resources, as they eliminate the need for manual data entry and review entirely!

Background information

Beyond automation with all its errors (OCR faults) and flaws, the B-Op technology offers the next level of order validation as:

- contracts are exchanged over the B-Op network automatically: Each purchase order is covered by a contract, which is mutually signed and exchanged over the network with all details.

- the invoice validation happens already on the vendor side: Vendors are only permitted to send bills into the network when they have a purchase contract exactly matching the billing details.

- bills are enriched by customer background information: As the purchasing process is handled entirely digital on the customer and the vendor side, all details on the customer side (which are not known by the vendor) can be matched and can be used for automatic validation.

- delivery check: As B-Op is not a standalone purchasing tool, but also includes warehousing and inventory managment functionality, it also is able to gather information from the other processes, which can (with a certain trust level reached) remove the necessity to verify the effective receipt of goods in the procurement tool.

Benfits of b-op in this process

The usage of b-op comes with these advantages for both parties throughout the process:

- Digital Collaboration Data Model - b-op virtually creates a shared data object with three categories of data posession: customer data, shared data, vendor data. This approach is 100% compliant with data protection and privacy regulations.

- Integrated process - All information from the order process can fully be used in the accounts payable process.

Tangible benefits on the customer side

- Internal costcenter distribution - during ordering process the system automatically ensures the validity of the costcenter, so that problems of invoices with wrong or invalid costcenters is dramatically reduced.

- Full digitalization - the entire P2P process can be digitalized and automated for non-standard orders by an ever increasing number of tools and innovation partners developing procurement tools with us. This helps avoid any manual work on once established processes.

- Integration with approval process - orders can only be placed, when cleared by the organization. If no clearance exists, no b-op PO is created and no bill can be automatically cleared for payment

- Integration with warehousing - so called PO-Flip processes are entirely obsolete

- Exact position matching - each invoice position is inherently referenced to a purchase order and contract position, so that all information is usable at the invoice checking.

- Over- and underdelivery accross multiple purchase orders - as products are fully described in a structured form (even on customizated products) in b-op, the system can automatically detect deliveries on non linked purchase orders.

- Process Transparency - as all information is shared fully automated in the background all information (also from the vendor side) are available locally and immediately in a digital form. This reduces the number of support calls and iquiries ("where is my stuff?") dramatically through the entire P2P process.

Tangible benefits on the supplier side

- Full digitalization - the entire P2P process can be digitalized and automated for non-standard orders by an ever increasing number of tools and innovation partners developing procurement tools with us. This helps avoid any manual work on once established processes.

- Competitive advantage - customers are generally more happy, when they have no work with procurement and have all information available at any time without having to call someone.

- Get your money faster - As invoicing is fully digitalized bills can be sent automatically and without any manual work. Also they are processed immediately without any delay on the customer side.